It’s already that time of year again! We’ve just launched our End of Financial Year Sale with some excellent deals to help you get the most out of tax time for your business.

We’ve come up with unbeatable prices on our superior quality, Australian made sheds. With major discounts on our Farmers Mate, Solid Industrial, Tough Triple, Huge Open Ended shed and many more, look no further than Now Buildings for your new shed.

We’ve also done the research on how you can make tax time work for you and your business.

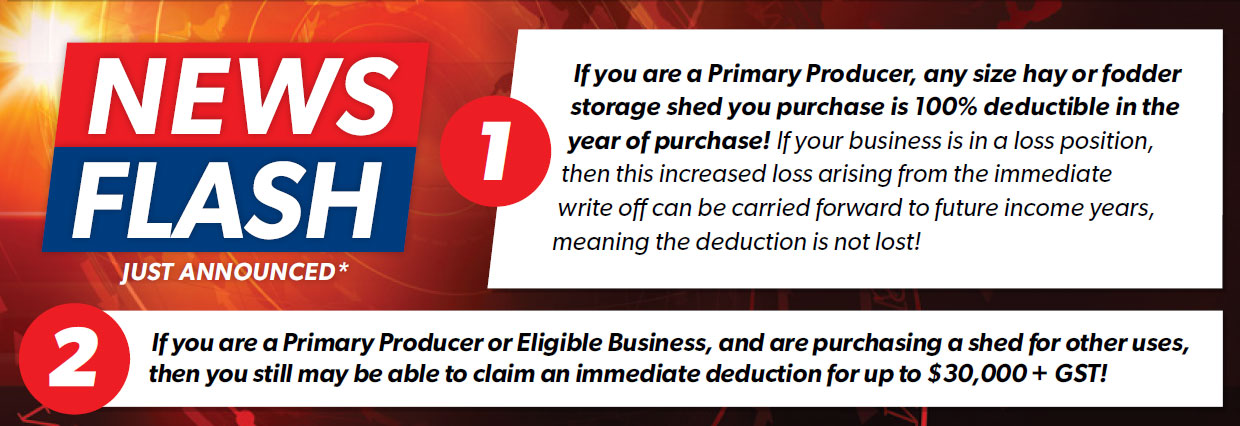

If you are a Primary Producer, any size hay or fodder storage shed you purchase is 100% deductible in the year of purchase. If your business is in a loss position, then this increased loss arising from the immediate write off can be carried forward to future income years, meaning the deduction is not lost.

Alternatively, If you are a Primary Producer or Eligible Business, and are purchasing ashed for other uses, then you still may be able to claim an immediate deduction for up to $30,000 + GST.

Please consult your own tax and accounting advisers and find out if you or your business are eligible for this financial year.

Click here and fill out the form to see our latest specials for your area